BREIT Tax Highlights

BREIT offers compelling after-tax distributions.1

THIS PAGE AND ITS CONTENTS ARE NOT TO BE VIEWED BY OR DISTRIBUTED TO FINANCIAL ADVISORS OR INVESTORS IN THE STATES OF NEW JERSEY, OHIO OR WASHINGTON

This page and its contents are not to be viewed by or distributed to financial advisors or investors in the states of New Jersey, Ohio or Washington.

Compelling Distributions

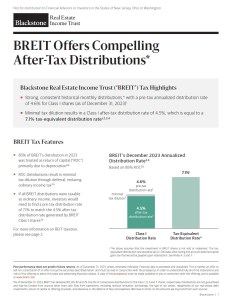

BREIT’s December 2023 Annualized Distribution Rate5,6

Based on 85% ROC7,8

The above assumes that the investment in BREIT shares is not sold or redeemed. The tax-equivalent distribution rate would be up to 1.3% lower after taking into account deferred capital gains tax that would be payable upon redemption. See Notes 6, 7 and 9.

BREIT Tax Features

- 85% of BREIT’s distribution in 2023 was treated as return of capital (“ROC”) primarily due to depreciation7,8

- ROC distributions result in minimal tax dilution through deferral, reducing ordinary income tax4,7

- If all BREIT distributions were taxable as ordinary income, investors would need to find an investment that generates a pre-tax distribution rate of 7.1% to match the 4.5% after-tax distribution rate generated by BREIT Class I shares5,6

How REIT Taxation Works

Key Takeaway

A high ROC percentage combined with favorable REIT tax rates can decrease a REIT investor’s effective federal tax rate on distributions to 4.4% for investors in the highest marginal tax bracket7,8,9

REIT Tax Treatment5

- Real Estate Investment Trust (REIT) distributions are taxed at different rates depending on whether they are characterized as ordinary income, capital gains or return of capital

- A notable advantage of REITs is the ability to characterize a portion of distributions that would otherwise be treated as ordinary income as ROC due to real estate-related factors such as depreciation

- ROC distributions are tax deferred until redemption, at which time they give rise to capital gains

- Inherited REIT shares are generally eligible for a tax-free step-up in basis to the prevailing fair market value at the time of transfer10

- In addition, REIT investors benefit from a 20% tax rate reduction to individual tax rates on the ordinary income portion of distributions9

BREIT Tax Highlights

Performance

Learn morePerformance

Why Invest in BREIT

learn MoreWhy Invest in BREIT

All information is as of December 31, 2023, unless otherwise noted. Financial data is estimated and unaudited. This tax information is provided for informational purposes only, is subject to material change, and should not be relied upon as a guarantee or prediction of tax effects. This material also does not constitute tax advice to, and should not be relied upon by, potential investors, who should consult their own tax advisors regarding the matters discussed herein and the tax consequences of an investment. A return of capital in this context is intended to mean a current income distribution which is not a taxable dividend (as defined in IRC Section 316) and which reduces or exceeds the adjusted basis of the shareholder’s stock (i.e., a Section 301(c)(2) or Section 302(c)(3) distribution). No inference should be made about the source of the current income distribution (including the taxable and non‑taxable components). This material contains references to our net asset value (“NAV”) and NAV‑based calculations, which involve significant professional judgment. Our NAV is generally equal to the fair value of our assets less outstanding liabilities, calculated in accordance with our valuation guidelines. The calculated value of our assets and liabilities may differ from our actual realizable value or future value which would affect the NAV as well as any returns derived from that NAV, and ultimately the value of your investment. As return information is calculated based on NAV, return information presented will be impacted should the assumptions on which NAV was determined prove to be incorrect. NAV is not a measure used under generally accepted accounting principles (“GAAP”) and will likely differ from the GAAP value of our equity reflected in our financial statements. As of March 31, 2024, our total equity under GAAP, excluding non-controlling third-party JV interests, was $36.3 billion and our NAV was $59.3 billion. As of March 31, 2024, our NAV per share was $14.18, $13.96, $13.86 and $14.19 for Class S, Class T, Class D and Class I shares, respectively, and GAAP equity per share/unit was $8.67. GAAP equity accounts for net income as calculated under GAAP, and we have incurred $138.4 million in net losses, excluding net losses attributable to non-controlling interests in third-party JV interests, for the three months ended March 31, 2024. Our net income (loss) as calculated under GAAP and a reconciliation of our GAAP equity, excluding non-controlling third-party JV interests, to our NAV are provided in our annual and interim financial statements. As of March 31, 2024, 100% of inception to date distributions were funded from cash flows from operations. For further information, please refer to “Net Asset Value Calculation and Valuation Guidelines” in BREIT’s prospectus, which describes our valuation process and the independent third parties who assist us.

- As of December 31, 2023, BREIT has delivered 82, 80, 82 and 79 months of consecutive distributions for the Class I, D, S and T shares, respectively. Distributions are not guaranteed and may be funded from sources other than cash flow from operations, including, without limitation, borrowings, the sale of our assets, repayments of our real estate debt investments, return of capital or offering proceeds, and advances or the deferral of fees and expenses. We have no limits on the amounts we may fund from such sources.

- As of December 31, 2023. Performance varies by share class. Distribution rates (pre‑tax) for the other class shares are as follows: Class D: 4.5%; Class S: 3.8% and Class T: 3.8%. Reflects the current month’s distribution as of December 31, 2023 annualized and divided by the prior month’s net asset value, which is inclusive of all fees and expenses. There is no assurance we will pay distributions in any particular amount, if at all. Any distributions we make will be at the discretion of our board of directors. As of March 31, 2024, 100% of inception to date distributions were funded from cash flows from operations. Class I shares require a minimum investment of $1,000,000, unless waived by the dealer manager, and are generally available for purchase only through fee‑based programs, also known as wrap accounts, or other similar alternative fee arrangements that provide access to Class I shares, or by our officers and directors, officers and employees of our affiliates, and their immediate family members. Before making an investment decision, prospective investors should consult with their investment adviser regarding their account type and classes of common stock they may be eligible to purchase.

- The chart above assumes that the investment in BREIT shares is not sold or redeemed. The tax-equivalent distribution rate would be up to 1.3% lower after taking into account deferred capital gains tax that would be payable upon redemption. See Notes 6, 7 and 9.

- Tax dilution refers to the difference between the pre-tax and after-tax distribution rates. The dilution for all share classes based on BREIT’s annualized distribution rate as of December 31, 2023, were as follows: Class I: 0.17%; Class D: 0.16%; Class S: 0.14%; Class T: 0.14%. Reflects BREIT’s 2023 ROC of 85%. BREIT’s ROC in 2017, 2018, 2019, 2020, 2021 and 2022 was 66%, 97%, 90%, 100%, 92% and 94%, respectively.

- BREIT’s after‑tax distribution rate for all share classes as of December 31, 2023 were as follows: Class I: 4.5% (4.6% pre‑tax ‑ 0.17% tax dilution = 4.5% after‑tax); Class D: 4.3% (4.5% pre‑tax ‑ 0.16% tax dilution = 4.3% after‑tax); Class S: 3.6% (3.8% pre‑tax ‑ 0.14% tax dilution = 3.6% after‑tax); Class T: 3.7% (3.8% pre‑tax ‑ 0.14% tax dilution = 3.7% after‑tax). Calculations may not sum due to rounding. After‑tax distribution rate is reflective of the current tax year and does not take into account other taxes that may be owed on an investment in a REIT when the investor redeems his or her shares. Upon redemption, the investor may be subject to higher capital gains taxes as a result of a lower cost basis due to the return of capital distributions.

- Tax-equivalent distribution rate herein reflects the pre-tax distribution rate an investor would need to receive from a theoretical investment to match the 4.5% after-tax distribution rate earned by a BREIT Class I stockholder in 2023, if the distributions from the theoretical investment (i) were classified as ordinary income subject to tax at the top marginal tax rate of 37%, (ii) did not benefit from the 20% tax rate deduction and (iii) were not classified as ROC. The ordinary income tax rate could change in the future. Tax-equivalent distribution rate for the other share classes are as follows: Class D: 6.9%; Class S: 5.8%; and Class T: 5.9%. The tax-equivalent distribution rate would be reduced by 1.3%, 1.2%, 1.0% and 1.1% for Class I, D, S and T shares, respectively, taking into account deferred capital gains tax that would be payable upon redemption. This assumes a one-year holding period and includes the impact of deferred capital gains tax incurred in connection with a redemption of BREIT shares. Upon redemption, an investor is assumed to be subject to tax on all prior return of capital distributions at the current maximum capital gains rate of 20%. The capital gains rate could change in the future. Investors should consult their own tax advisors.

- Return of capital distributions reduce the stockholder’s tax basis in the year the distribution is received, and generally defer taxes on that portion until the stockholder’s stock is sold via redemption. Upon redemption, the investor may be subject to higher capital gains taxes as a result of a lower cost basis due to the return of capital distributions. Certain non-cash deductions, such as depreciation and amortization, lower the taxable income for REIT distributions.

- Investors should be aware that a REIT’s ROC percentage may vary significantly in a given year and, as a result, the impact of the tax law may vary significantly from year to year. The hypothetical example is intended to show the likely effects of existing tax laws and is for information purposes only. There can be no assurance that the actual results will be similar to the example set forth herein or that BREIT will be able to effectively implement its investment strategy, achieve its investment objectives, be profitable or avoid losses. While we currently believe that the estimations and assumptions referenced herein are reasonable under the circumstances, there is no guarantee that the conditions upon which such assumptions are based will materialize or are otherwise applicable. This example does not constitute a forecast, and all assumptions herein are subject to uncertainties, changes and other risks, any of which may cause the relevant actual, financial and other results to be materially different from the results expressed or implied by the information presented herein. No assurance, representation or warranty is made by any person that any of the estimations herein will be achieved, and no recipient of this example should rely on such estimations. Investors may also be subject to net investment income taxes of 3.8% and/or state income tax in their state of residence, which would lower the after-tax distribution rate received by the investor.

- At this time, the 20% rate deduction to individual tax rates on the ordinary income portion of distributions is set to expire on December 31, 2025. The tax benefits are not applicable to capital gain dividends or certain qualified dividend income and are only available for qualified REITs. If BREIT did not qualify as a REIT, the tax benefit would be unavailable. BREIT’s board also has the authority to revoke its REIT election. There may be adverse legislative or regulatory tax changes and other investments may offer tax advantages without the set expiration. An accelerated depreciation schedule does not guarantee a profitable return on investment and return of capital reduces the basis of the investment.

- Eligibility for this benefit is dependent on the investor’s specific facts and circumstances. This information does not constitute tax advice to, and should not be relied upon by, potential investors, who should consult their own tax advisors.

Important Disclosure Information

Alternative investments often are speculative, typically have higher fees than traditional investments, often include a high degree of risk and are appropriate only for eligible, long-term investors who are willing to forgo liquidity and put capital at risk for an indefinite period of time. They may be highly illiquid and can engage in leverage and other speculative practices that may increase volatility and risk of loss.

Alternative investments involve complex tax structures, tax inefficient investing, and delays in distributing important tax information. Individual funds have specific risks related to their investment programs that will vary from fund to fund. Investors should consult their own tax and legal advisors as Dealers generally do not provide tax or legal advice. REITs are generally not taxed at the corporate level to the extent they distribute all of their taxable income in the form of dividends. Ordinary income dividends are taxed at individual tax rates and distributions may be subject to state tax. Each investor’s tax considerations are different and consulting a tax advisor is recommended. Any of the data provided herein should not be construed as investment, tax, accounting or legal advice.

Interests in alternative investment products are distributed by the applicable Dealer and (1) are not FDIC-insured, (2) are not deposits or other obligations of such Dealer or any of its affiliates, and (3) are not guaranteed by such Dealer and its affiliates. Each Dealer is a registered broker-dealer, not a bank.

Select Images. The selected images of certain BREIT investments in this website are provided for illustrative purposes only, are not representative of all BREIT investments of a given property type and are not representative of BREIT’s entire portfolio. It should not be assumed that BREIT’s investment in the properties identified and discussed herein were or will be profitable. Please refer to https://www.breit.com/properties for a complete list of BREIT’s real estate investments (excluding equity in public and private real estate related companies), including BREIT’s ownership interest in such investments.

Trends. There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results.

Summary of Risk Factors

BREIT is a non-listed REIT that invests primarily in stabilized income-generating commercial real estate investments across asset classes in the United States (“U.S.”) and, to a lesser extent, real estate debt investments, with a focus on current income. We invest to a lesser extent in countries outside of the U.S. This investment involves a high degree of risk. You should purchase these securities only if you can afford the complete loss of your investment. You should read the prospectus carefully for a description of the risks associated with an investment in BREIT. These risks include, but are not limited to, the following:

- Since there is no public trading market for our common stock, repurchase of shares by us will likely be the only way to dispose of your shares. Our share repurchase plan, which is approved and administered by our board of directors, provides stockholders with the opportunity to request that we repurchase their shares on a monthly basis, but we are not obligated to repurchase any shares and our board of directors may determine to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month in its discretion. In addition, repurchases will be subject to available liquidity and other significant restrictions, including repurchase limitations that have in the past been, and may in the future be, exceeded, resulting in our repurchase of shares on a pro rata basis. Further, our board of directors may, in certain circumstances, make exceptions to, modify or suspend our share repurchase plan. As a result, our shares should be considered as having only limited liquidity and at times may be illiquid.

- Distributions are not guaranteed and may be funded from sources other than cash flow from operations, including, without limitation, borrowings, the sale of our assets, repayments of our real estate debt investments, return of capital or offering proceeds, and advances or the deferral of fees and expenses. We have no limits on the amounts we may fund from such sources.

- The purchase and repurchase price for shares of our common stock are generally based on our prior month’s net asset value (“NAV”) and are not based on any public trading market. While there will be independent annual appraisals of our properties, the appraisal of properties is inherently subjective, and our NAV may not accurately reflect the actual price at which our properties could be liquidated on any given day.

- We are dependent on BX REIT Advisors L.L.C. (the “Adviser”) to conduct our operations, as well as the persons and firms the Adviser retains to provide services on our behalf. The Adviser will face conflicts of interest as a result of, among other things, the allocation of investment opportunities among us and Other Blackstone Accounts (as defined in BREIT’s prospectus), the allocation of time of its investment professionals and the substantial fees that we will pay to the Adviser.

- On acquiring shares, an investor will experience immediate dilution in the net tangible book value of the investor’s investment.

- There are limits on the ownership and transferability of our shares.

- We intend to continue to qualify as a REIT for U.S. federal income tax purposes. However, if we fail to qualify as a REIT and no relief provisions apply, our NAV and cash available for distribution to our stockholders could materially decrease.

- We do not own the Blackstone name, but we are permitted to use it as part of our corporate name pursuant to a trademark license agreement with an affiliate of Blackstone Inc. (“Blackstone”). Use of the name by other parties or the termination of our trademark license agreement may harm our business.

- The acquisition of investment properties may be financed in substantial part by borrowing, which increases our exposure to loss. The use of leverage involves a high degree of financial risk and will increase the exposure of our investments to adverse economic factors such as rising interest rates, downturns in the economy or deteriorations in the condition of our investments.

- Investing in commercial real estate assets involves certain risks, including but not limited to: adverse changes in values or operating results caused by global and national economic and market conditions generally and by the local economic conditions where our properties are located, including changes with respect to rising vacancy rates or decreasing market rental rates; tenants’ inability to pay rent; increases in interest rates and lack of availability of financing; tenant turnover and vacancies; and changes in supply of or demand for similar properties in a given market.

- Our portfolio is currently concentrated in certain industries and geographies, and, as a consequence, our aggregate return may be substantially affected by adverse economic or business conditions affecting that particular type of asset or geography.

- Local, regional, or global events such as war (e.g., Russia/Ukraine), acts of terrorism, public health issues like pandemics or epidemics (e.g., COVID-19), recessions, or other economic, political and global macro factors and events could lead to a substantial economic downturn or recession in the U.S. and global economies and have a significant impact on BREIT and its investments. The recovery from such downturns is uncertain and may last for an extended period of time or result in significant volatility, and many of the risks discussed herein associated with an investment in BREIT may be increased.

Certain information contained in this material has been obtained from sources outside Blackstone, which in certain cases has not been updated through the date hereof. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and none of Blackstone, its funds, nor any of their affiliates takes any responsibility for, and has not independently verified, any such information. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates.

Opinions expressed reflect the current opinions of BREIT as of the date appearing in the materials only and are based on BREIT’s opinions of the current market environment, which is subject to change. Stockholders, financial professionals and prospective investors should not rely solely upon the information presented when making an investment decision and should review the most recent prospectus, as supplemented, available at www.breit.com. Certain information contained in the materials discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice.

All rights to the trademarks and/or logos presented herein belong to their respective owners and Blackstone’s use hereof does not imply an affiliation with, or endorsement by, the owners of these logos.

Clarity of text on this website may be affected by the size of the screen on which it is displayed.

Forward-Looking Statements

This website contains “forward-looking statements” within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by the use of forward-looking terminology such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “identified,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates”, “confident,” “conviction” or other similar words or the negatives thereof. These may include financial estimates and their underlying assumptions, statements about plans, objectives, intentions, and expectations with respect to positioning, including the impact of macroeconomic trends and market forces, future operations, repurchases, acquisitions, future performance and statements regarding identified but not yet closed acquisitions. Such forward-looking statements are inherently subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in BREIT’s prospectus and annual report for the most recent fiscal year, and any such updated factors included in BREIT’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this document (or BREIT’s public filings). Except as otherwise required by federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

Blackstone Securities Partners L.P. (“BSP”) is a broker-dealer whose purpose is to distribute Blackstone managed or affiliated products. BSP provides services to its Blackstone affiliates, not to investors in its funds, strategies or other products. BSP does not make any recommendation regarding, and will not monitor, any investment. As such, when BSP presents an investment strategy or product to an investor, BSP does not collect the information necessary to determine—and BSP does not engage in a determination regarding—whether an investment in the strategy or product is in the best interests of, or is suitable for, the investor. You should exercise your own judgment and/or consult with a professional advisor to determine whether it is advisable for you to invest in any Blackstone strategy or product. Please note that BSP may not provide the kinds of financial services that you might expect from another financial intermediary, such as overseeing any brokerage or similar account. For financial advice relating to an investment in any Blackstone strategy or product, contact your own professional advisor.

This website must be read in conjunction with BREIT’s prospectus in order to fully understand all the implications and risks of an investment in BREIT. Please refer to the prospectus for more information regarding state suitability standards and consult a financial professional for share class availability and appropriateness.

THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED IN THE PROSPECTUS FOR THE OFFERING, AS AMENDED AND SUPPLEMENTED (THE “PROSPECTUS”). THE OFFERING IS MADE ONLY BY THE PROSPECTUS AND THIS MATERIAL MUST BE PRECEDED OR ACCOMPANIED BY THE PROSPECTUS. NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY OTHER STATE SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THE PROSPECTUS IS TRUTHFUL OR COMPLETE. IN ADDITION, THE ATTORNEY GENERAL OF THE STATE OF NEW YORK HAS NOT PASSED ON OR ENDORSED THE MERITS OF THE OFFERING. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.