Showing 1 - 12 of 210

| Investment | Sort by Sector | Number of Properties(1) | Location | Sort by Acquisition Date | Ownership Interest(2) |

Square Feet (in thousands) Units / Keys(3) |

Occupancy Rate(4) |

|---|---|---|---|---|---|---|---|

| Wasatch 2-Pack | Rental Housing | 2 | Various | October 2022 | 100% | 350 units | 92% |

| Grizzly Multifamily Portfolio | Rental Housing | 1 | Atlanta, GA | October 2022 | 100% | 425 units | 95% |

| ACG V Multifamily | Rental Housing | 2 | Stockton, CA | September 2022 | 95% | 449 units | 96% |

| American Campus Communities | Rental Housing | 144 | Various | August 2022 | 69% | 35,283 units | 96% |

| Adare Office | Office | 1 | Dublin, Ireland | August 2022 | 75% | 517 sq. ft | 100% |

| Sleep Extended Stay Hotel Portfolio8 | Hospitality | 196 | Various | July 2022 | 30% | 24,937 keys | N/A |

| Pike Multifamily Portfolio5 | Rental Housing | 46 | Various | June 2022 | 100% | 12,594 units | 93% |

| Atlanta Tech Center 2.0 Office | Office | 1 | Atlanta, GA | June 2022 | 100% | 318 sq. ft | 100% |

| Pike Office Portfolio5 | Office | 2 | Various | June 2022 | 100% | 258 sq. ft | 100% |

| Pike Retail Portfolio5,10 | Retail | 46 | Various | June 2022 | Various | 4,944 sq. ft | 95% |

| Rapids Multifamily Portfolio | Rental Housing | 37 | Various | May 2022 | 100% | 11,245 units | 93% |

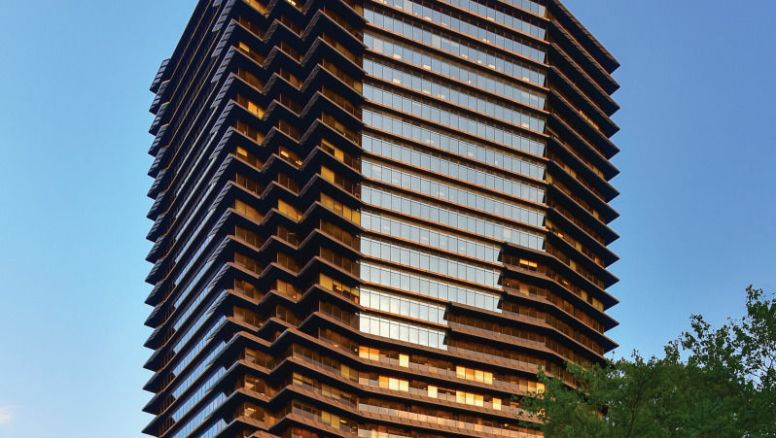

| 8 Spruce Street Multifamily | Rental Housing | 1 | New York, NY | May 2022 | 100% | 900 units | 93% |

Past performance does not predict future returns. Financial information is approximate and as of March 31, 2024, unless otherwise noted. The words “we”, “us”, and “our” refer to BREIT, together with its consolidated subsidiaries, including BREIT Operating Partnership L.P., unless the context requires otherwise.

- Rental Housing includes multifamily and other types of rental housing such as student, affordable, manufactured and single family rental housing, as well as senior living. Rental Housing units include multifamily units, student housing units, affordable housing units, manufactured housing sites, single family rental homes and senior living units. Single family rental homes are accounted for in rental housing units and are not reflected in the number of properties.

- Certain of our joint venture agreements provide the seller or the other partner a profits interest based on achieving certain internal rate of return hurdles. Such investments are consolidated by us and any profits interest due to the other partners is reported within non-controlling interests. The table above also includes properties owned by unconsolidated entities.

- Excludes 2.0 million and 11.4 million square feet of land under development related to our data centers and industrial investments, respectively.

- For our industrial, net lease, data centers, retail and office investments, occupancy includes all leased square footage as of March 31, 2024. For our multifamily, student housing and affordable housing investments, occupancy is defined as the percentage of actual rent divided by gross potential rent (defined as actual rent for occupied units and market rent for vacant units) for the three months ended March 31, 2024. For our single family rental housing investments, the occupancy rate includes occupied homes for the three months ended March 31, 2024. For our self storage, manufactured housing and senior living investments, the occupancy rate includes occupied square footage, occupied sites and occupied units, respectively, as of March 31, 2024. The average occupancy rate for our hospitality investments includes paid occupied rooms for the 12 months ended March 31, 2024. Hospitality investments owned less than 12 months are excluded from the average occupancy rate calculation. Unconsolidated investments are excluded from occupancy rate calculations.

- Represents acquisition of Preferred Apartment Communities (“PAC”).

- Includes a 100% interest in 17,255 consolidated single family rental homes, a 44% interest in 8,839 unconsolidated single family rental homes, and a 12% interest in 1,780 unconsolidated single family rental homes.

- Includes various ownership interests in 445 consolidated affordable housing units and 10 unconsolidated affordable housing units.

- Investment is unconsolidated.

- Includes various ownership interests in 100 consolidated industrial properties and 26 unconsolidated industrial properties.

- Includes 45 wholly-owned retail properties and a 50% interest in one unconsolidated retail property.

Summary of Risk Factors

BREIT is a non-listed REIT that invests primarily in stabilized income-generating commercial real estate investments across asset classes in the United States and, to a lesser extent, real estate debt investments, with a focus on current income. We invest to a lesser extent in countries outside of the U.S. This investment involves a high degree of risk. You should purchase these securities only if you can afford the complete loss of your investment. You should read the prospectus carefully for a description of the risks associated with an investment in BREIT. These risks include, but are not limited to, the following:

- Since there is no public trading market for our common stock, repurchase of shares by us will likely be the only way to dispose of your shares. Our share repurchase plan, which is approved and administered by our board of directors, provides stockholders with the opportunity to request that we repurchase their shares on a monthly basis, but we are not obligated to repurchase any shares and our board of directors may determine to repurchase only some, or even none, of the shares that have been requested to be repurchased in any particular month in its discretion. In addition, repurchases will be subject to available liquidity and other significant restrictions, including repurchase limitations that have in the past been, and may in the future be, exceeded, resulting in our repurchase of shares on a pro rata basis. Further, our board of directors may, in certain circumstances, make exceptions to, modify or suspend our share repurchase plan. As a result, our shares should be considered as having only limited liquidity and at times may be illiquid.

- Distributions are not guaranteed and may be funded from sources other than cash flow from operations, including, without limitation, borrowings, the sale of our assets, repayments of our real estate debt investments, return of capital or offering proceeds, and advances or the deferral of fees and expenses. We have no limits on the amounts we may fund from such sources.

- The purchase and repurchase price for shares of our common stock are generally based on our prior month’s net asset value (“NAV”) and are not based on any public trading market. While there will be independent annual appraisals of our properties, the appraisal of properties is inherently subjective, and our NAV may not accurately reflect the actual price at which our properties could be liquidated on any given day.

- We are dependent on BX REIT Advisors L.L.C. (the “Adviser”) to conduct our operations, as well as the persons and firms the Adviser retains to provide services on our behalf. The Adviser will face conflicts of interest as a result of, among other things, the allocation of investment opportunities among us and Other Blackstone Accounts (as defined in BREIT’s prospectus), the allocation of time of its investment professionals and the substantial fees that we will pay to the Adviser.

- On acquiring shares, an investor will experience immediate dilution in the net tangible book value of the investor’s investment.

- There are limits on the ownership and transferability of our shares.

- We intend to continue to qualify as a REIT for U.S. federal income tax purposes. However, if we fail to qualify as a REIT and no relief provisions apply, our NAV and cash available for distribution to our stockholders could materially decrease.

- We do not own the Blackstone name, but we are permitted to use it as part of our corporate name pursuant to a trademark license agreement with an affiliate of Blackstone Inc. (“Blackstone”). Use of the name by other parties or the termination of our trademark license agreement may harm our business.

- The acquisition of investment properties may be financed in substantial part by borrowing, which increases our exposure to loss. The use of leverage involves a high degree of financial risk and will increase the exposure of our investments to adverse economic factors such as rising interest rates, downturns in the economy or deteriorations in the condition of our investments.

- Investing in commercial real estate assets involves certain risks, including but not limited to: adverse changes in values or operating results caused by global and national economic and market conditions generally and by the local economic conditions where our properties are located, including changes with respect to rising vacancy rates or decreasing market rental rates; tenants’ inability to pay rent; increases in interest rates and lack of availability of financing; tenant turnover and vacancies; and changes in supply of or demand for similar properties in a given market.

- Our portfolio is currently concentrated in certain industries and geographies, and, as a consequence, our aggregate return may be substantially affected by adverse economic or business conditions affecting that particular type of asset or geography.

- Local, regional, or global events such as war (e.g., Russia/Ukraine), acts of terrorism, public health issues like pandemics or epidemics (e.g., COVID-19), recessions, or other economic, political and global macro factors and events could lead to a substantial economic downturn or recession in the U.S. and global economies and have a significant impact on BREIT and its investments. The recovery from such downturns is uncertain and may last for an extended period of time or result in significant volatility, and many of the risks discussed herein associated with an investment in BREIT may be increased.

Certain information contained in this material has been obtained from sources outside Blackstone, which in certain cases has not been updated through the date hereof. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and none of Blackstone, its funds, nor any of their affiliates takes any responsibility for, and has not independently verified, any such information. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates.

Opinions expressed reflect the current opinions of BREIT as of the date appearing in the materials only and are based on BREIT’s opinions of the current market environment, which is subject to change. Stockholders, financial professionals and prospective investors should not rely solely upon the information presented when making an investment decision and should review the most recent prospectus, as supplemented, available at www.breit.com. Certain information contained in the materials discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice.

All rights to the trademarks and/or logos presented herein belong to their respective owners and Blackstone’s use hereof does not imply an affiliation with, or endorsement by, the owners of these logos.

Clarity of text on this website may be affected by the size of the screen on which it is displayed.

Forward-Looking Statements

This website contains forward-looking statements within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by the use of forward-looking terminology such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “identified,” “may,” “will,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates”, “confident,” “conviction” or other similar words or the negatives thereof. These may include financial estimates and their underlying assumptions, statements about plans, objectives, intentions, and expectations with respect to positioning, including the impact of macroeconomic trends and market forces, future operations, repurchases, acquisitions, future performance and statements regarding identified but not yet closed acquisitions. Such forward-looking statements are inherently subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in BREIT’s prospectus and annual report for the most recent fiscal year, and any such updated factors included in BREIT’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this website (or BREIT’s public filings). Except as otherwise required by federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

Blackstone Securities Partners L.P. (“BSP”) is a broker-dealer whose purpose is to distribute Blackstone managed or affiliated products. BSP provides services to its Blackstone affiliates, not to investors in its funds, strategies or other products. BSP does not make any recommendation regarding, and will not monitor, any investment. As such, when BSP presents an investment strategy or product to an investor, BSP does not collect the information necessary to determine—and BSP does not engage in a determination regarding—whether an investment in the strategy or product is in the best interests of, or is suitable for, the investor. You should exercise your own judgment and/or consult with a professional advisor to determine whether it is advisable for you to invest in any Blackstone strategy or product. Please note that BSP may not provide the kinds of financial services that you might expect from another financial intermediary, such as overseeing any brokerage or similar account. For financial advice relating to an investment in any Blackstone strategy or product, contact your own professional advisor.

This website must be read in conjunction with BREIT’s prospectus in order to fully understand all the implications and risks of an investment in BREIT. Please refer to the prospectus for more information regarding state suitability standards and consult a financial professional for share class availability and appropriateness.

THIS IS NEITHER AN OFFER TO SELL NOR A SOLICITATION OF AN OFFER TO BUY THE SECURITIES DESCRIBED IN THE PROSPECTUS FOR THE OFFERING, AS AMENDED AND SUPPLEMENTED (THE “PROSPECTUS”). THE OFFERING IS MADE ONLY BY THE PROSPECTUS AND THIS MATERIAL MUST BE PRECEDED OR ACCOMPANIED BY THE PROSPECTUS. NEITHER THE SECURITIES AND EXCHANGE COMMISSION NOR ANY OTHER STATE SECURITIES REGULATOR HAS APPROVED OR DISAPPROVED OF THE SECURITIES OR DETERMINED IF THE PROSPECTUS IS TRUTHFUL OR COMPLETE. IN ADDITION, THE ATTORNEY GENERAL OF THE STATE OF NEW YORK HAS NOT PASSED ON OR ENDORSED THE MERITS OF THE OFFERING. ANY REPRESENTATION TO THE CONTRARY IS UNLAWFUL.