Q1 2025 Update for Stockholders

Q1 2025 Update for Stockholders

May 7, 2025

Dear BREIT Stockholder,

BREIT is off to a strong start in 2025 amidst tremendous volatility and declines in the public markets. Healthy cash flow growth powered a +1.9% net return in Q1 (Class I), our best quarter since Q3’23.1,3* Private real estate outperformance through periods of volatility isn’t new. In fact, in the eight years of negative returns for the S&P 500 since 1980, seven were positive for private real estate. Two of those years were since BREIT’s inception (2018 and 2022), and in both of those years, BREIT returned +8%.4 We believe this is why you want to be invested in BREIT across market cycles: BREIT is a diversifying source of return in portfolios.

Since inception over eight years ago, BREIT has generated a +9.4% annualized net return (Class I), ~65% higher than publicly traded REITs and ~3x private real estate, as well as consistent historical monthly distributions with potential tax benefits.1,2 In 2024, 96% of BREIT’s distribution was classified as return of capital, bringing our 4.8% pre-tax Class I distribution rate to 7.5% on a tax-equivalent basis.5,6**

Year to Date Return, Not Annualized1,2

BREIT in Today’s Investment Environment

Against a backdrop of global macro uncertainty driven by recent tariff announcements, we believe investors want to own hard assets in the right sectors and markets at a discount to physical replacement cost.7 Unlike the public markets, BREIT’s performance is primarily driven by underlying real estate fundamentals and cash flow growth, not public market forces like sentiment or geopolitical uncertainty.

While the recovery has not been V-shaped, we believe the pillars of the real estate recovery remain intact despite the challenges in the broader investment environment today. Unlike other asset classes, we believe real estate values have already reset over the past few years and the recovery is just getting started, with values up only 5% from the 2023 trough.8 We believe private real estate offers compelling relative value today, particularly when compared to the S&P 500 and corporate bonds, which earlier this year peaked at 78% and 31%, respectively, above their 2022 lows.9

Importantly, we continue to see healthy supply-demand fundamentals drive resilient cash flow growth.3* BREIT’s portfolio is concentrated in sectors with powerful secular demand tailwinds that we expect will generate growth in excess of GDP.10 We have strategically invested in areas where structural shifts – like U.S. reindustrialization, Sunbelt migration and the rise of artificial intelligence (“AI”) and cloud computing – are transforming where people live, how they shop and how they use technology and real estate. The supply backdrop in our key sectors is equally favorable, with multifamily and industrial supply down two-thirds from 2022 levels to ten-year lows.11,12 The cost to build an industrial asset has doubled over the last several years, and we believe that tariffs will drive these replacement costs even higher and further constrain new supply.7 All of this is very supportive of BREIT’s existing real estate asset values.

Despite this more uncertain macro environment, capital markets remain open which is a critical driver of the broader real estate recovery. Although we have seen some widening in spreads and base rate volatility since the tariff announcements, the cost of capital remains 15% lower than a year ago and 40% lower than the 2023 peak.13 We also continue to see strong lending appetite from banks who are generally underallocated to real estate.14

Finally, although tariff announcements have created noise around inflation, inflation has already come down significantly in recent years, with the March inflation print at the lowest level since 2021.15 While goods inflation could accelerate, we believe this will likely be transitory and further declines in other components of the Consumer Price Index (“CPI”) like energy, services and shelter costs should mitigate the overall inflationary impact of tariffs. However, in the event we see higher inflation, real estate has historically served as an effective hedge.16

Portfolio in a Position of Strength

BREIT’s portfolio of Blackstone Real Estate’s best ideas is ~90% concentrated in rental housing, industrial and data centers and ~70% concentrated in fast-growing Sunbelt markets.17 Our conviction in these sectors and markets is underpinned by secular megatrends that we believe will continue to generate growth in excess of GDP.10

In a risk-off world, we believe rental housing is the kind of asset class you want to own. Demand for rental housing has been durable across market cycles because people always need a place to live, with U.S. multifamily occupancy averaging ~95% over the long term.18 We have also seen strong in-migration trends in BREIT’s Sunbelt markets drive healthy apartment demand. While we did see excess construction in the Sunbelt moderate multifamily rent growth in recent years, ~80% of BREIT’s multifamily markets are now at or past peak supply and new deliveries will continue to decline sharply over the next year.19 This will only exacerbate the existing 4-5M home shortfall in the U.S., which combined with the fact that it is ~50% more expensive to own vs. rent, all sets up a very favorable outlook.20,21

BREIT’s industrial portfolio continues to be powered by long-term tailwinds including the need for faster e-commerce deliveries and the reindustrialization of U.S. manufacturing, both of which generate significant local demand for infill warehouses. Since 2021, chip manufacturers, pharmaceutical companies and electric vehicle companies have announced $700B in U.S. manufacturing investments, driving an estimated 3-5x increase in spillover warehouse demand from their supply chain.22,23 BREIT is well-positioned to capture this because our portfolio is concentrated in top-performing markets in hotspots for reindustrialization such as Chicago, Atlanta and Dallas. BREIT also has limited exposure to coastal markets that may be more impacted by tariff-related disruptions. This resilient demand backdrop and collapsing new supply should generate continued cash flow growth, particularly as market rents are on average 22% above BREIT’s in-place rents.24

Data centers continue to benefit from a once-in-a-generation explosion in demand from the rise of AI and migration to the cloud. The largest hyperscalers have increased their data center capital expenditures by 3x since 2022 and continue to reaffirm their commitment to investing in digital infrastructure as they grow their cloud businesses and increase their AI deployments.25 Since Blackstone acquired our data center platform, QTS, in 2021, QTS’ leased capacity has grown by 9x and today is the largest data center company in the world.26 QTS is also the most active developer in the U.S. with a $25B+ development pipeline that is 100% pre-leased to investment-grade tenants with 15+ year leases.27*** In addition, QTS owns land with access to critical power that could support another $80B+ of construction.27*** Amidst the recent tariff announcements, QTS remains well-positioned as 90% of its total costs, including materials, equipment and labor, are domestically sourced with no direct exposure to tariffs. In addition to proactive supply chain management, QTS’ credibility with customers, significant land bank, access to power and scale capital position QTS particularly well to deliver in today’s dynamic environment.

These healthy fundamentals across our key sectors are driving BREIT’s estimated 4% cash flow growth in the first quarter.3 In addition, another driver of cash flow growth and ultimately long-term performance for BREIT is our embedded growth potential. Market rents in our portfolio are on average 12% above BREIT’s in-place rents today, which we expect to capture as leases expire over the next few years even without further market rent growth.28

We believe now is the time to be invested in BREIT and we are excited to build on our momentum so far in 2025. As we look ahead, we believe BREIT is exceptionally well-positioned to deliver diversification, stability and strong long-term performance.

We remain grateful for your partnership and trust.

Highlights from BREIT’s Q1 Stockholder Event

Hear takeaways from our Q1 2025 stockholder event featuring Jon Gray, Nadeem Meghji, Wesley LePatner and Zaneta Koplewicz.

BREIT Highlights

9.4%

annualized net return for Class I since inception in January 20171

~65%

higher returns than publicly traded REITs total return since January 20172

+4%

BREIT est. Q1’25 cash flow growth3*

Real Estate Values Have Reset = Attractive Relative Value

Asset Class Performance9,29

Total Returns, Indexed, September 2022 = 100

Diversification Benefits Amidst Market Volatility

Private Real Estate Returns vs. S&P 5004

Annual Total Returns Since 1980

Private real estate outperformance: 7 of 8 years

Industrial Spotlight: 24% of Portfolio

Reindustrialization Driving Long-Term Infill Demand…

Driving Need for Warehouses

~$700B

U.S. manufacturing investment announcements since 202122

3-5x

multiplier effect on industrial space from new manufacturing23

New Investment Announcements32

“TSMC intends to expand its investment in

the United States to $165B to power the future of AI”

– March 2025

“Apple will spend $500B+ in the U.S. over the

next four years. Plans include a new factory in Texas”

– February 2025

… Which BREIT is Well-Positioned to Capture

U.S. Manufacturing Investment Since 202133

Estimated Spillover Warehouse Demand

Q1 2025 BREIT Highlights

*Rental Housing includes the following subsectors as a percent of real estate asset value: multifamily (21%, including senior housing, which accounts for <1%), student housing (9%), single family rental housing (9%, including manufactured housing, which accounts for 1%) and affordable housing (8%).

Key Portfolio Metrics

Performance Summary

Total Returns (% Net of Fees)1

| Share Class | Q1 2025 | 1-Year | 3-Year | Annualized Inception to Date | |

|---|---|---|---|---|---|

| Class I | 1.9% | 2.0% | 2.2% | 9.4% | |

| Class D | (No Sales Load) (With Sales Load)40 | 1.8% 0.3% | 1.8% 0.3% | 2.0% 1.5% | 9.2% 9.0% |

| Class S | (No Sales Load) (With Sales Load)40 | 1.7% -1.8% | 1.2% -2.3% | 1.4% 0.2% | 8.5% 8.0% |

| Class T | (No Sales Load) (With Sales Load)40 | 1.7% -1.8% | 1.2% -2.3% | 1.3% 0.2% | 8.6% 8.1% |

Annualized Distribution Rates6

4.8%

Class I

4.7%

Class D

3.9%

Class S

4.0%

Class T

Download BREIT’s Q1 2025 Update

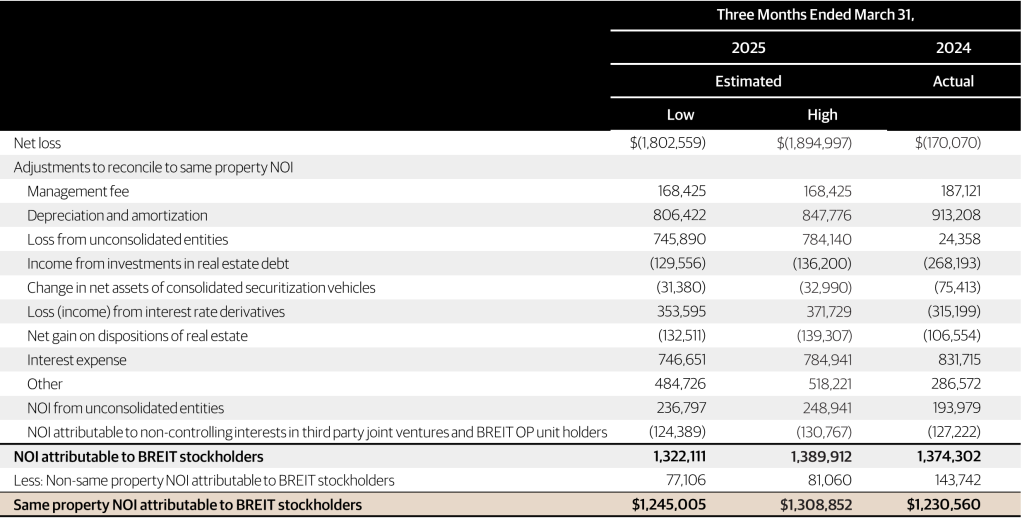

*Cash flow growth refers to same property net operating income (“NOI”) growth. Reflects BREIT’s year-over-year preliminary estimated same property NOI growth for the three months ended March 31, 2025. See “Important Disclosure Information–Preliminary Estimated Same Property NOI Growth”.

**Assumes that the investment in BREIT shares is not sold or redeemed. The tax-equivalent distribution rate would be up to 1.4% lower taking into account deferred capital gains tax that would be payable upon redemption. See notes 5 and 6 for more information.

***Reflects QTS’ development pipeline at 100% ownership interest. As of March 31, 2025, BREIT’s ownership interest in QTS was 35% and the QTS investment accounted for 14.6% of BREIT’s real estate asset value.

- Represents BREIT Class I shares. Please see above for Q1’25, 1-Year, 3-Year and Inception to date (“ITD”) net returns. YTD returns are not annualized. January 1, 2017 reflects BREIT Class I’s inception date. Returns shown reflect the percent change in the NAV per share from the beginning of the applicable period, plus the amount of any distribution per share declared in the period. All returns shown assume reinvestment of distributions pursuant to BREIT’s distribution reinvestment plan, are derived from unaudited financial information, and are net of all BREIT expenses, including general and administrative expenses, transaction related expenses, management fees, performance participation allocation, and share class-specific fees, but exclude the impact of early repurchase deductions on the repurchase of shares that have been outstanding for less than one year. The inception dates for the Class I, D, S and T shares are January 1, 2017, May 1, 2017, January 1, 2017 and June 1, 2017, respectively. The returns have been prepared using unaudited data and valuations of the underlying investments in BREIT’s portfolio, which are estimates of fair value and form the basis for BREIT’s NAV. Valuations based upon unaudited reports from the underlying investments may be subject to later adjustments, may not correspond to realized value and may not accurately reflect the price at which assets could be liquidated. As return information is calculated based on NAV, return information presented will be impacted should the assumptions on which NAV was determined prove to be different. Past performance does not predict future returns. The Q1’25 figures for BREIT, S&P 500, Publicly Traded REIT’s and Corporate Bonds was 1.9%, -4.3%, 1.1% and 1.0%, respectively. 3-Year returns are annualized consistent with the IPA Practice Guideline 2018. Please see www.breit.com/performance for information on BREIT returns.

- Publicly traded REITs reflect the MSCI US REIT Index total return as of March 31, 2025. BREIT’s Class I inception date is January 1, 2017. Private real estate reflects the net total return as of March 31, 2025, which is the latest data available. During the period from January 1, 2017 to March 31, 2025, BREIT Class I’s annualized total net return of 9.4% was 2.7x the NFI-ODCE annualized total net return of 3.5% and ~65% higher than the MSCI US REIT Index annualized total return of 5.7%. S&P 500 reflects total return. Corporate bonds reflect the total return of the ICE BofA U.S. High Yield Index. BREIT does not trade on a national securities exchange, and therefore, is generally illiquid. The volatility and risk profile of the indices presented are likely to be materially different from that of BREIT including that BREIT’s fees and expenses may be higher and BREIT shares are significantly less liquid than publicly traded companies. See “Important Disclosure Information–Index Definitions”.

- Cash flow growth refers to same property net operating income (“NOI”) growth. Reflects BREIT’s year-over-year preliminary estimated same property NOI growth for the year to date period ended March 31, 2025 (based on the midpoint of the preliminary estimated range of same property NOI). See “Important Disclosure Information–Preliminary Estimated Same Property NOI Growth”.

- Morningstar Direct, NCREIF, as of December 31, 2024. BREIT does not trade on a national securities exchange, and therefore, is generally illiquid. The volatility and risk profile of the indices presented are likely to be materially different from that of BREIT including that BREIT’s fees and expenses may be higher and BREIT shares are significantly less liquid than publicly traded companies. There can be no assurance that any Blackstone fund or investment will be able to implement its investment strategy, achieve its objectives or avoid substantial losses. Diversification does not assure a profit or protect against loss in a declining market. Reflects annual gross total returns and represents the 8 calendar-year periods since 1980 when the S&P 500 generated a negative return. Private real estate reflects the NFI-ODCE index, which reflects total returns of various private real estate funds and should not be considered reflective of the performance of BREIT. Indices are meant to illustrate general market performance. Since 1980 the S&P 500 has returned, on average, +13% returns while private real estate returned, on average, +8% returns. Comparisons shown are for informational purposes only, do not represent specific investments and are not a portfolio allocation recommendation. Over the last 20 years, (2005-2024), the S&P 500 and NFI-ODCE index have had a 0.0 correlation. 2 of the 8 years occurred after BREIT’s inception, 2018 and 2022. In 2018, the S&P 500 generated a -4.4% return and private real estate generated a 8.3% return. In 2022, the S&P 500 generated a -18.1% return and private real estate generated a 7.5% return. BREIT Class I returned 8.3% in 2018 and 8.4% in 2022. Please see www.breit.com/performance for information on BREIT returns. See “Important Disclosure Information–Index Definitions” and “–Trends”.

- Reflects the current month’s Class I distribution annualized and divided by the prior month’s net asset value, which is inclusive of all fees and expenses. Annualized distribution rate for the other share classes: Class D: 4.7%, Class S: 3.9% and Class T: 4.0%. Distributions are not guaranteed and may be funded from sources other than cash flow from operations, including, without limitation, borrowings, the sale of our assets, repayments of our real estate debt investments, ROC or offering proceeds, and advances or the deferral of fees and expenses. We have no limits on the amounts we may fund from such sources. Our inception to date cash flows from operating activities, along with net gains from investment realizations, have funded 100% of our distributions through December 31, 2024. See “Market for Registrant’s Common Equity, Related Stockholder Matters and Issuer Purchases of Equity Securities -Distributions” on BREIT’s Annual Report on Form 10-K for more information. A portion of REIT ordinary income distributions may be tax deferred given the ability to characterize ordinary income as ROC. ROC distributions reduce the stockholder’s tax basis in the year the distribution is received, and generally defer taxes on that portion until the stockholder’s stock is sold via redemption. Upon redemption, the investor may be subject to higher capital gains taxes as a result of a lower cost basis due to the ROC distributions. Certain non-cash deductions, such as depreciation and amortization, lower the taxable income for REIT distributions. BREIT’s ROC in 2017, 2018, 2019, 2020, 2021, 2022, 2023 and 2024 was 66%, 97%, 90%, 100%, 92%, 94%, 85% and 96%, respectively. See “Important Disclosure Information” including “Tax Information”.

- 7.5% tax-equivalent distribution rate assumes that the investment in BREIT shares is not sold or redeemed and reflects the pre-tax distribution rate an investor would need to receive from a theoretical investment to match the 4.8% after-tax distribution rate earned by a BREIT Class I stockholder based on BREIT’s 2024 ROC of 96%, if the distributions from the theoretical investment (i) were classified as ordinary income subject to tax at the top marginal tax rate of 37%, (ii) did not benefit from the 20% tax rate deduction and (iii) were not classified as ROC. The ordinary income tax rate could change in the future. Tax-equivalent distribution rate for the other share classes are as follows: Class D: 7.3%; Class S: 6.2%; and Class T: 6.3%. The tax-equivalent distribution rate would be reduced by 1.4%, 1.4%, 1.2% and 1.2% for Class I, D, S and T shares, respectively, taking into account deferred capital gains tax that would be payable upon redemption. This assumes a one-year holding period and includes the impact of deferred capital gains tax incurred in connection with a redemption of BREIT shares. Upon redemption, an investor is assumed to be subject to tax on all prior ROC distributions at the current maximum capital gains rate of 20%. The capital gains rate could change in the future. At this time, the 20% rate deduction to individual tax rates on the ordinary income portion of distributions is set to expire on December 31, 2025. See “Important Disclosure Information–Tax Information” for more information.

- Blackstone Proprietary Data, as of March 31, 2025. Reflects average increase in cost since December 31, 2019.

- Green Street Advisors, as of March 31, 2025. Reflects the Commercial Property Price Index for All Property, which captures the prices at which U.S. commercial real estate transactions are currently being negotiated and contracted. 5% reflects increase from the November 30, 2023 trough.

- The S&P 500 reflects total gross return, as of May 5, 2025. Oct’22 Trough refers to October 12, 2022. Corporate bonds reflect the total return of the ICE BofA U.S. High Yield Index, as of May 5, 2025. Sep’22 Trough refers to September 29, 2022. Real estate values reflect Green Street Advisors, as of April 30, 2025. Reflects the Commercial Property Price Index for All Property, which captures the prices at which U.S. commercial real estate transactions are currently being negotiated and contracted. Nov’23 Trough refers to November 30, 2023. During the period from September 30, 2022 to May 5, 2025, S&P 500 total returns were 63.8% and corporate bonds total returns were 29.4%. During the period from September 30, 2022 to April 30, 2025, real estate values decreased -12.3%. Comparisons shown are for informational purposes only, do not represent specific investments and are not a portfolio allocation recommendation. Between September 30, 2022 and May 1, 2025 the S&P 500 reached a peak on February 19, 2025, increasing 78% from the October 12, 2022 trough. Corporate bonds peaked on February 28, 2025, rising 31% from the September 29, 2022 trough.

- As of March 31, 2025. Strong growth in excess of GDP refers to BREIT’s strong estimated same property NOI growth of 4% in Q1’25 compared to annual GDP growth of 2% as of Q4’24. Gross Domestic Product (“GDP”) reflects Bureau of Economic Analysis data, as of March 31, 2025, released April 30, 2025.

- RealPage Market Analytics, as of December 31, 2024. Represents annual starts as a percent of prior year end stock figures. Data reflects institutional-quality product across RealPage Market Analytics Top 150-tracked markets. Multifamily starts are distinct from U.S. Census completions (which have recently been elevated), starts and permits and total housing supply (which include both single family and multifamily), which may differ in volume over a given period. As of March 31, 2025, the multifamily (including senior housing) and affordable housing sectors accounted for 21% and 8% of BREIT’s real estate asset value, respectively.

- CoStar, as of January 15, 2025. Represents annual starts as a percent of prior year-end stock figures. As of March 31, 2025, the industrial sector accounted for 24% of BREIT’s real estate asset value.

- Blackstone Proprietary Data, as of April 17, 2025. Refers to decreasing all-in cost of capital and increasing availability of debt. Represents estimated all-in borrowing costs for high-quality logistics portfolio transactions. Base rate reflects 3-year SOFR swap rate (’23 wide as of October 18, 2023, and today as of April 17, 2025). ’23 Wide spread reflects SASB CMBS and represents weighted average spread across all rating tranches applied to estimated rating agency capital structures from each respective period. Spread today reflects bank balance sheet. There can be no assurance that financing costs will continue to decline and changes in this measure may have a negative impact on our performance.

- Blackstone Proprietary Data, as of March 31, 2025. Reflects Blackstone Real Estate Americas financings.

- Inflation level reflects U.S. Bureau of Labor Statistics data, as of March 31, 2025, released April 10, 2025. There is no assurance that BREIT will be able to achieve its investment objective or will effectively hedge inflation.

- There is no assurance that any Blackstone fund or strategy will effectively hedge inflation. Inflation hedge refers to growth in real estate net operating income (“NOI”) generally outpacing inflation. NOI reflects Green Street Advisors data, as of December 31, 2024. 2024 NOI growth represents year-end estimate as of February 5, 2025. U.S. CPI reflects Bureau of Labor Statistics data, as of December 31, 2024. NOI growth represents the average NOI growth by year across the equal-weighted average of the asset-weighted average of the multifamily, industrial, mall, office and shopping center sectors. Multifamily refers to apartments; shopping center refers to strip retail. The Consumer Price Index (CPI) measures changes in the prices paid by urban consumers for a representative basket of goods and services. NOI may not be correlated to or continue to keep pace with inflation. See “Important Disclosure Information–Trends”.

- “Property Sector” weighting is measured as the asset value of real estate investments for each sector category divided by the asset value of all of BREIT’s real estate investments, excluding the value of any third-party interests in such real estate investments. Rental housing includes the following subsectors: multifamily (21%, including senior housing, which accounts for <1%), student housing (9%), single family rental housing (9%, including manufactured housing, which accounts for 1%) and affordable housing (8%). Please see the prospectus for more information on BREIT’s investments. “Region Concentration” represents regions as defined by the National Council of Real Estate Investment Fiduciaries (“NCREIF”) and the weighting is measured as the asset value of real estate properties for each regional category divided by the asset value of all of BREIT’s real estate properties, excluding the value of any third-party interests in such real estate properties. “Sunbelt” reflects the South and West regions of the U.S. as defined by NCREIF. “Non-U.S.” reflects investments in Europe and Canada. Our portfolio is currently concentrated in certain industries and geographies, and, as a consequence, our aggregate return may be substantially affected by adverse economic or business conditions affecting that particular type of asset or geography. “Fast-growing” reflects comparison between the South and West regions (“Sunbelt”) versus the rest of the United States as defined by NCREIF. Population growth reflects U.S. Bureau of Economic Analysis, as of September 30, 2024. Represents 5-year compound annual growth rate of population from mid-quarter Q3 2019 to mid-quarter Q3 2024. Job growth reflects U.S. Bureau of Labor Statistics data as of September 30, 2024. Represents 5-year compound annual growth rate of seasonally adjusted employees on nonfarm payrolls from September 2019 to September 2024. Wage growth reflects U.S. Bureau of Labor Statistics, as of June 30, 2024. Represents 5-year compound annual growth rate of employment-weighted average weekly wages from Q2 2019 to Q2 2024. Although a market may be a growth market as of the date of the publication of this material, demographics and trends may change and investors are cautioned on relying upon the data presented as there is no guarantee that historical trends will continue or that BREIT could benefit from such trends.

- Axiometrics, as of December 31, 2024. Reflects national multifamily occupancy presented on a trailing 4-quarter average.

- RealPage Market Analytics as of December 31, 2024. Reflects multifamily delivery forecast in BREIT’s U.S. multifamily markets. ~80% refers to the percentage of BREIT multifamily markets forecasted to be at or past peak supply by March 31, 2025. As of March 31, 2025, the multifamily (including senior housing) and affordable housing sectors accounted for 21% and 8% of BREIT’s real estate asset value, respectively.

- U.S. Census Bureau and Bureau of Economic Analysis, as of February 28, 2025. Refers to cumulative deficit of single family and multifamily completions over the last decade compared to the 10-year pre-GFC average.

- Blackstone Proprietary Data as of April 11, 2025. Represents the difference between monthly cost of ownership (including mortgage payments, taxes, maintenance costs, insurance and HOA fees) and monthly rents for HPA and Tricon portfolios. Cost of ownership assumes 30-yr. fixed rate FHA mortgage, 3.5% amortized loan closing costs and 3.5% down payment.

- Blackstone Proprietary Data, as of April 22, 2025.

- JLL, as of January 2025. “Multiplier effect” refers to the incremental demand for industrial real estate driven by operational partners-suppliers, distributors and third-party logistics operators required for new manufacturing facilities.

- Blackstone Proprietary Data. Represents our estimate of the average embedded rent growth potential of BREIT’s industrial portfolio based on the difference between current in-place rents and current achievable market rents. See “Important Disclosure Information—Embedded Growth”.This is not a measure, or indicative, of overall portfolio performance or returns. Certain other BREIT property sectors have lower embedded rent growth potential. BREIT’s industrial portfolio has a 3.5-year weighted average lease length. See note 28 for more information on embedded growth potential in BREIT’s portfolio.

- Morgan Stanley Equity Research, as of February 2025 and RBC Equity Research as of November 2024. Represents 2022 and 2025 forecasted capital expenditure investments in data centers by Alphabet, Amazon, Meta, Microsoft and Oracle.

- Based on leased megawatts at acquisition vs. March 31, 2025 (at 100% ownership). As of March 31, 2025, BREIT’s ownership in QTS was 35% and the QTS investment accounted for 14.6% of BREIT’s real estate asset value. There can be no assurance that these leases will commence on their current expected terms, or at all, and this information should not be considered an indication of future performance. “Largest” refers to leased megawatts and reflects Blackstone Proprietary Data as of December 31, 2024.

- As of March 31, 2025. Development pipeline reflects total cost for committed development projects at 100% ownership and reflects signed development projects. There can be no assurance that these development projects will commence on their current expected terms, or at all, and this information should not be considered an indication of future performance. Future development potential reflects cost estimate of developing data center projects on existing land bank acres at 100% ownership and excludes committed development projects. This information is provided to illustrate the potential for additional development projects at QTS’s existing land bank acres, and there can be no assurance that any development projects will arise at these land bank acres. In addition, future land bank opportunities could be allocated to other Blackstone vehicles instead of to QTS or BREIT.

- Blackstone Proprietary Data. Represents our estimate of the average embedded rent growth potential of BREIT’s portfolio based on the difference between current in-place rents and current achievable market rents. See “Important Disclosure Information—Embedded Growth”. This is not a measure, or indicative, of overall portfolio performance or returns. Certain individual BREIT property sectors may have lower embedded rent growth potential, including rental housing, which accounts for 47% of BREIT’s real estate asset value as of March 31, 2025, and has an average 4% embedded rent growth potential as of March 31, 2025. BREIT’s portfolio has a 4.4-year weighted average lease length. Reflects real estate properties only, including unconsolidated properties, and does not include real estate debt investments. For a complete list of BREIT’s real estate investments (excluding equity in public and private real estate-related companies), visit www.breit.com/properties. Embedded rent growth will not directly correlate with increased performance or returns and is presented for illustrative purposes only and does not constitute forecasts. There can be no assurance that any such results will actually be achieved. A number of factors, including operating expenses as described in “Important Disclosure Information– Preliminary Estimated Same Property NOI Growth”, will impact BREIT’s net performance or returns. Any expectations that in-place rents have the potential to increase are based on certain assumptions that may not be correct and on certain variables that may change.

- There remains significant uncertainty regarding the future direction, scope and duration of tariffs imposed by the U.S. government. New tariffs and retaliatory measures may adversely affect the global economy and our operations or impose an adverse impact on us that could outweigh any benefits from constrained supply. The above is meant to provide context for educational purposes only and is not intended to interpret the long term implications of tariffs on performance. See “Important Disclosure Information–Trends”.

- Blackstone Proprietary Data, as of March 31, 2025. Reflects occupied industrial space in the BREIT portfolio for the respective quarter end.

- Represents Q1’25 quarterly leasing spreads and compares new or renewal rents to prior rents or expiring rents, as applicable.

- Taiwan Semiconductor Manufacturing Company, as of March 4, 2025. Apple, as of February 24, 2025.

- The markets (metropolitan statistical areas, or “MSA”) and states displayed above accounted for 56% of BREIT’s industrial real estate value. BREIT is invested in additional MSAs and states which are not named above. Measured as the asset value of real estate properties in each market or state listed above divided by the asset value of all of BREIT’s real estate industrial properties, excluding the value of any third-party interests in such properties. Estimated new warehouse demand based on recent announcements using approximately number of employees required per square foot by sector. Estimated manufacturing space and warehouse distribution space associated with U.S. manufacturing investment announcements.

- Total asset value is measured as (i) the asset value of real estate investments (based on fair value), excluding any third party interests in such real estate investments, plus (ii) the equity in our real estate debt investments measured at fair value (defined as the asset value of our real estate debt investments less the financing on such investments), but excluding any other assets (such as cash or any other cash equivalents). The total asset value would be higher if such amounts were included and the value of our real estate debt investments was not decreased by the financing on such investments. “Real estate investments” include wholly-owned property investments, BREIT’s share of property investments held through joint ventures and equity in public and private real estate related companies. “Real estate debt investments” include BREIT’s investments in commercial mortgage-backed securities, residential mortgage-backed securities, mortgage loans and other debt secured by real estate and real estate related assets, as described in BREIT’s prospectus. The Consolidated GAAP Balance Sheet included in our annual and interim financial statements reflects the loan collateral underlying certain of our real estate debt investments on a gross basis. These amounts are excluded from our real estate debt investments as they do not reflect our economic interest in such assets.

- Number of properties reflects real estate investments only, including unconsolidated properties, and does not include real estate debt investments. Single family rental homes are not reflected in the number of properties.

- Occupancy is an important real estate metric because it measures the utilization of properties in the portfolio. Occupancy is weighted by the total value of all consolidated real estate properties, excluding our hospitality investments, and any third-party interests in such properties. For our industrial, net lease, data centers, office and retail investments, occupancy includes all leased square footage as of the date indicated. For our multifamily, student housing and affordable housing investments, occupancy is defined as the percentage of actual rent divided by gross potential rent (defined as actual rent for occupied units and market rent for vacant units) for the three months ended on the date indicated. For our single family rental housing investments, the occupancy rate includes occupied homes for the month ended on the date indicated. For our self storage, manufactured housing and senior living investments, the occupancy rate includes occupied square footage, occupied sites and occupied units, respectively, as of the date indicated. The average occupancy rate for our hospitality investments was 73% for the twelve months ended December 31, 2024 and includes paid occupied rooms. Hospitality investments owned less than 12 months are excluded from the average occupancy rate calculation. Unconsolidated investments are excluded from occupancy rate calculations.

- Our leverage ratio is measured by dividing (i) consolidated property-level and entity-level debt net of cash and loan-related restricted cash, by (ii) the asset value of real estate investments (measured using the greater of fair market value and cost) plus the equity in our settled real estate debt investments. Indebtedness incurred (i) in connection with funding a deposit in advance of the closing of an investment or (ii) as other working capital advances will not be included as part of the calculation above. The leverage ratio would be higher if the indebtedness on our real estate debt investments and the pro rata share of debt within our unconsolidated investments were taken into account. The use of leverage involves a high degree of financial risk and may increase the exposure of the investments to adverse economic factors.

- Percentage fixed-rate financing is measured by dividing (i) the sum of our consolidated fixed-rate debt, secured financings on investments in real estate debt, and the outstanding notional principal amount of corporate and consolidated interest rate swaps, by (ii) total consolidated debt outstanding inclusive of secured financings on investments in real estate debt.

- Investment allocation is measured as the asset value of each investment category (real estate investments or real estate debt investments) divided by the total asset value of all investment categories, excluding the value of any third party interests in such assets.

- Assumes payment of the full upfront sales charge at initial subscription (1.5% for Class D shares; 3.5% for Class S and Class T shares). The sales charge for Class D shares became effective May 1, 2018.

Important Disclosure Information

Past performance does not predict future returns. Financial data is estimated and unaudited. All figures as of March 31, 2025 unless otherwise noted. Opinions expressed reflect the current opinions of BREIT as of the date appearing in the materials only and are based on BREIT’s opinions of the current market environment, which is subject to change. Certain information contained in the materials discusses general market activity, industry or sector trends, or other broad-based economic, market or political conditions and should not be construed as research or investment advice.

The properties, sectors and geographies referenced herein do not represent all BREIT investments. The selected investment examples presented or referred to herein may not be representative of all transactions of a given type or of investments generally and are intended to be illustrative of the types of investments that have been made or may be made by BREIT in employing its investment strategies. It should not be assumed that BREIT’s investment in the properties identified and discussed herein were or will be profitable or that BREIT will make equally successful or comparable investments in the future. Please refer to https://www.breit.com/properties for a complete list of real estate investments (excluding equity in public and private real estate related companies).

Blackstone Proprietary Data. Certain information and data provided herein is based on Blackstone proprietary knowledge and data. Portfolio companies may provide proprietary market data to Blackstone Inc. (“Blackstone”), including about local market supply and demand conditions, current market rents and operating expenses, capital expenditures and valuations for multiple assets. Such proprietary market data is used by Blackstone to evaluate market trends as well as to underwrite potential and existing investments. While Blackstone currently believes that such information is reliable for purposes used herein, it is subject to change, and reflects Blackstone’s opinion as to whether the amount, nature and quality of the data is sufficient for the applicable conclusion, and no representations are made as to the accuracy or completeness thereof.

Embedded Growth. Embedded growth represents Blackstone’s expectations for growth based on its view of the current market environment taking into account rents that are currently below market rates and therefore have the potential to increase. These expectations are based on certain assumptions that may not be correct and on certain variables that may change, are presented for illustrative purposes only and do not constitute forecasts. There can be no assurance that any such results will actually be achieved.

Logos. All rights to the trademarks and/or logos presented herein belong to their respective owners and Blackstone’s use hereof does not imply an affiliation with, or endorsement by, the owners of these logos.

Preliminary Estimated Same Property NOI Growth. Represents BREIT’s year-to-date preliminary estimated same property NOI growth for the three months ended March 31, 2025 compared to the prior year (based on the midpoint of the preliminary estimated range of same property NOI). This data is not a comprehensive statement of our financial results for the three months ended March 31, 2025, and our actual results may differ materially from this preliminary estimated data. Net Operating Income (“NOI”) is a supplemental non-GAAP measure of our property operating results that we believe is meaningful because it enables management to evaluate the impact of occupancy, rents, leasing activity and other controllable property operating results at our real estate. We define NOI as operating revenues less operating expenses, which exclude (i) impairment of investments in real estate, (ii) depreciation and amortization, (iii) straight-line rental income and expense, (iv) amortization of above- and below-market lease intangibles, (v) amortization of accumulated unrealized gains on derivatives previously recognized in other comprehensive income, (vi) lease termination fees, (vii) property expenses not core to the operations of such properties, (viii) other non-property-related revenue and expense items such as (a) general and administrative expenses, (b) management fee paid to the Adviser, (c) performance participation allocation paid to the Special Limited Partner, (d) incentive compensation awards, (e) income (loss) from investments in real estate debt, (f) change in net assets of consolidated securitization vehicles, (g) income (loss) from interest rate derivatives, (h) net gain on dispositions of real estate, (i) interest expense, net, (j) loss on extinguishment of debt, (k) other income (expense), and (ix) similar adjustments for NOI attributable to non-controlling interests and unconsolidated entities. We evaluate our consolidated results of operations on a same-property basis, which allows us to analyze our property operating results excluding acquisitions and dispositions during the periods under comparison. Properties in our portfolio are considered same property if they were owned for the full periods presented, otherwise they are considered non-same property. Recently developed properties are not included in same property results until the properties have achieved stabilization for both full periods presented. We define stabilization for the property as the earlier of (i) achieving 90% occupancy, (ii) 12 months after receiving a certificate of occupancy, or (iii) for Data Centers 12 months after receiving a certificate of occupancy and greater than 50% of its critical IT capacity has been built. Certain assets are excluded from same property results and are considered non-same property, including (i) properties held-for-sale, (ii) properties that are being redeveloped, (iii) properties identified for future sale, and (iv) interests in unconsolidated entities under contract for sale with hard deposit or other factors ensuring the buyer’s performance. We do not consider our investments in the real estate debt segment or equity securities to be same property. For more information, please refer to BREIT’s Current Report on Form 8-K filed with the Securities and Exchange Commission on April 17, 2025 and the prospectus. Additionally, please refer to below for a reconciliation of preliminary estimated GAAP loss to preliminary estimated same property NOI for the three months ended March 31, 2025 and 2024.

Select Images. The selected images of certain BREIT investments in this presentation are provided for illustrative purposes only, are not representative of all BREIT investments of a given property type and are not representative of BREIT’s entire portfolio. It should not be assumed that BREIT’s investment in the properties identified and discussed herein were or will be profitable. Please refer to www.breit.com/properties for a complete list of BREIT’s real estate investments (excluding equity in public and private real estate related companies), including BREIT’s ownership interest in such properties.

Tax Information. The tax information herein is provided for informational purposes only, is subject to material change, and should not be relied upon as a guarantee or prediction of tax effects. This material also does not constitute tax advice to, and should not be relied upon by, potential investors, who should consult their own tax advisors regarding the matters discussed herein and the tax consequences of an investment. A portion of REIT ordinary income distributions may be tax deferred given the ability to characterize ordinary income as Return of Capital (“ROC”). ROC distributions reduce the stockholder’s tax basis in the year the distribution is received, and generally defer taxes on that portion until the stockholder’s stock is sold via redemption. Upon redemption, the investor may be subject to higher capital gains taxes as a result of a lower cost basis due to the ROC distributions. Certain non-cash deductions, such as depreciation and amortization, lower the taxable income for REIT distributions. Investors should be aware that a REIT’s ROC percentage may vary significantly in a given year and, as a result, the impact of the tax law and any related advantage may vary significantly from year to year. At this time, the 20% rate deduction to individual tax rates on the ordinary income portion of distributions is set to expire on December 31, 2025. The tax benefits are not applicable to capital gain dividends or certain qualified dividend income and are only available for qualified REITs. If BREIT did not qualify as a REIT, the tax benefit would be unavailable. BREIT’s board also has the authority to revoke its REIT election. There may be adverse legislative or regulatory tax changes and other investments may offer tax advantages without the set expiration. An accelerated depreciation schedule does not guarantee a profitable return on investment and ROC reduces the basis of the investment. While we currently believe that the estimations and assumptions referenced herein are reasonable under the circumstances, there is no guarantee that the conditions upon which such assumptions are based will materialize or are otherwise applicable. This information does not constitute a forecast, and all assumptions herein are subject to uncertainties, changes and other risks, any of which may cause the relevant actual, financial and other results to be materially different from the results expressed or implied by the information presented herein. No assurance, representation or warranty is made by any person that any of the estimations herein will be achieved, and no recipient of this example should rely on such estimations. Investors may also be subject to net investment income taxes of 3.8% and/or state income tax in their state of residence which would lower the after-tax distribution rate received by the investor.

Third Party Information. Certain information contained in this material has been obtained from sources outside Blackstone, which in certain cases have not been updated through the date hereof. While such information is believed to be reliable for purposes used herein, no representations are made as to the accuracy or completeness thereof and none of Blackstone, its funds, nor any of their affiliates takes any responsibility for, and has not independently verified, any such information. This information involves a number of assumptions and limitations, and you are cautioned not to give undue weight to these estimates.

Trends. There can be no assurances that any of the trends described herein will continue or will not reverse. Past events and trends do not imply, predict or guarantee, and are not necessarily indicative of, future events or results.

Use of Leverage. BREIT uses and expects to continue to use leverage. If returns on such investment exceed the costs of borrowing, investor returns will be enhanced. However, if returns do not exceed the costs of borrowing, BREIT performance will be depressed. This includes the potential for BREIT to suffer greater losses than it otherwise would have. The effect of leverage is that any losses will be magnified. The use of leverage involves a high degree of financial risk and will increase BREIT’s exposure to adverse economic factors such as rising interest rates, downturns in the economy or deteriorations in the condition of BREIT’s investments. This leverage may also subject BREIT and its investments to restrictive financial and operating covenants, which may limit flexibility in responding to changing business and economic conditions. For example, leveraged entities may be subject to restrictions on making interest payments and other distributions.

Index Definitions

An investment in BREIT is not a direct investment in real estate, and has material differences from a direct investment in real estate, including those related to fees and expenses, liquidity and tax treatment. BREIT’s share price is subject to less volatility because its per share NAV is based on the value of real estate assets it owns and is not subject to market pricing forces as are the prices of the asset classes represented by the indices presented. Although BREIT’s share price is subject to less volatility, BREIT shares are significantly less liquid than these asset classes, and are not immune to fluctuations. Private real estate is not traded on an exchange and will have less liquidity and price transparency. The value of private real estate may fluctuate and may be worth less than was initially paid for it.

The volatility and risk profile of the indices presented is likely to be materially different from that of BREIT including those related to fees and expenses, liquidity, safety, and tax features. In addition, the indices employ different investment guidelines and criteria than BREIT; as a result, the holdings in BREIT may differ significantly from the holdings of the securities that comprise the indices. The indices are not subject to fees or expenses, are meant to illustrate general market performance and it may not be possible to invest in the indices. The performance of the indices has not been selected to represent an appropriate benchmark to compare to BREIT’s performance, but rather is disclosed to allow for comparison of BREIT’s performance to that of well-known and widely recognized indices. A summary of the investment guidelines for the indices presented is available upon request. In the case of equity indices, performance of the indices reflects the reinvestment of dividends.

BREIT does not trade on a national securities exchange, and therefore, is generally illiquid. Your ability to redeem shares in BREIT through BREIT’s share repurchase plan may be limited, and fees associated with the sale of these products can be higher than other asset classes. In some cases, periodic distributions may be subsidized by borrowed funds and include a return of investor principal. This is in contrast to the distributions investors receive from large corporate stocks that trade on national exchanges, which are typically derived solely from earnings. Investors typically seek income from distributions over a period of years. Upon liquidation, ROC may be more or less than the original investment depending on the value of assets.

An investment in BREIT (i) differs from the Green Street Commercial Property Price Index in that such index represents various private real estate values with differing sector concentrations (ii) differs from high yield bonds and the ICE BofA U.S. High Yield Index in that private real estate investments are not fixed-rate debt instruments and such bonds represent debt issued by corporations across a variety of issuers with varying pricing, terms and conditions, (iii) differs from the MSCI U.S. REIT Index in that BREIT is not a publicly traded U.S. Equity REIT, (iv) differs from the NFI-ODCE in that such index represents various private real estate funds with differing terms and strategies, and (v) differs from equities and the S&P 500 Index in that private real estate investments are not large or mid cap stocks and are not publicly traded.

- The Green Street Commercial Property Price Index (“CPPI”) is a value-weighted time series of unleveraged U.S. commercial property values with an inception date of December 31, 1997. CPPI is shown to illustrate general market trends for informational purposes only, does not represent any specific investment and does not reflect how BREIT has performed or will perform in the future. The index captures the prices at which commercial real estate transactions are currently being negotiated and contracted, measuring price changes across select property types covered by Green Street Advisors. All Property Sector weights: retail (20%), apartments (15%), health care (15%), industrial (12.5%), office (12.5%), lodging (7.5%), data center (5%), net lease (5%), self-storage (5%), and manufactured home park (2.5%). Apartments refers to multifamily, lodging refers to hospitality.

- The ICE BofA U.S. High Yield Index is a capitalization-weighted index that measures the performance of USD-denominated, below investment grade rated, fixed rate corporate debt publicly issued in the US domestic market. An investment in high-yield corporate bonds is generally considered to be a less risky investment than private real estate.

- The MSCI U.S. REIT Index is a free float-adjusted market capitalization index that is comprised of equity REITs. The index is based on the MSCI USA Investable Market Index (IMI), its parent index, which captures large, mid and small cap securities. It represents about 99% of the U.S. REIT universe. The index is calculated with dividends reinvested on a daily basis.

- The NFI-ODCE is a capitalization-weighted, gross of fees, time-weighted return index with an inception date of December 31, 1977. Published reports also contain equal-weighted and net of fees information. Open-end funds are generally defined as infinite-life vehicles consisting of multiple investors who have the ability to enter or exit the fund on a periodic basis, subject to contribution and/or redemption requests, thereby providing a degree of potential investment liquidity. The term diversified core equity typically reflects lower risk investment strategies utilizing low leverage and is generally represented by equity ownership positions in stable U.S. operating properties diversified across regions and property types. While funds used in the NFI-ODCE have characteristics that differ from BREIT (including differing management fees and leverage), BREIT’s management feels that the NFI-ODCE is an appropriate and accepted index for the purpose of evaluating the total returns of direct real estate funds. Comparisons shown are for illustrative purposes only and do not represent specific investments. Investors cannot invest in this index. BREIT has the ability to utilize higher leverage than is allowed for the funds in the NFI-ODCE, which could increase BREIT’s volatility relative to the index. Additionally, an investment in BREIT is subject to certain fees that are not contemplated in the NFI-ODCE.

- The S&P 500 Index is a market capitalization-weighted index that includes 500 stocks representing all major industries. Returns are denominated in U.S. dollars. The S&P 500 Index is a proxy of the performance of the broad U.S. economy through changes in aggregate market value. The S&P 500 Index is a widely used barometer of U.S. stock market performance. The key risk of the S&P 500 Index is the volatility that comes with exposure to the stock market.

Forward-Looking Statement Disclosure

This material contains forward-looking statements within the meaning of the federal securities laws and the Private Securities Litigation Reform Act of 1995. These forward-looking statements can be identified by the use of forward-looking terminology such as “outlook,” “indicator,” “believes,” “expects,” “potential,” “continues,” “identified,” “may,” “will,” “could,” “should,” “seeks,” “approximately,” “predicts,” “intends,” “plans,” “estimates,” “anticipates”, “confident,” “conviction” or other similar words or the negatives thereof. These may include financial estimates and their underlying assumptions, statements about plans, objectives, intentions, and expectations with respect to positioning, including the impact of macroeconomic trends and market forces, future operations, repurchases, acquisitions, future performance and statements regarding identified but not yet closed acquisitions or dispositions and pre-leased but not yet occupied development properties. Such forward-looking statements are inherently subject to various risks and uncertainties. Accordingly, there are or will be important factors that could cause actual outcomes or results to differ materially from those indicated in such statements. We believe these factors include but are not limited to those described under the section entitled “Risk Factors” in BREIT’s prospectus and annual report for the most recent fiscal year, and any such updated factors included in BREIT’s periodic filings with the SEC, which are accessible on the SEC’s website at www.sec.gov. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this document (or BREIT’s public filings). Except as otherwise required by federal securities laws, we undertake no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future developments or otherwise.

The following table reconciles preliminary estimated GAAP net loss to preliminary estimated same property NOI for the three months ended March 31, 2025 and 2024 (unaudited, $ in thousands). Same property NOI growth is estimated to be 4% in the three months ended March 31, 2025 based on the midpoint of the estimated year-over-year increase.